Key Highlights

- Insurance eligibility verification ensures healthcare providers confirm a patient’s insurance coverage before delivering medical services, reducing claim denials and delays.

- Proper verification processes improve patient satisfaction and operational efficiency while safeguarding financial stability for healthcare practices.

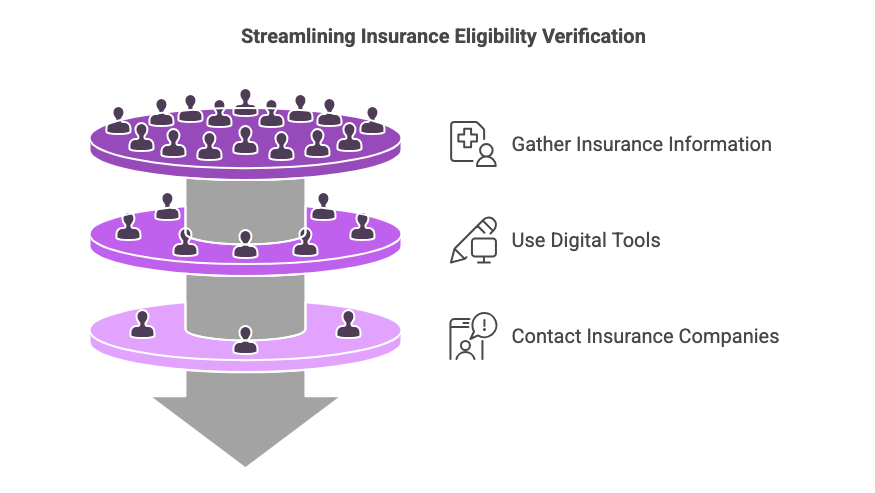

- Essential documents, digital tools, and informed communication streamline accuracy in eligibility checks.

- Step-by-step guidance on gathering insurance details, using online tools, and direct contact with insurance companies supports effective checks.

The Importance of Accurate Insurance Information

-

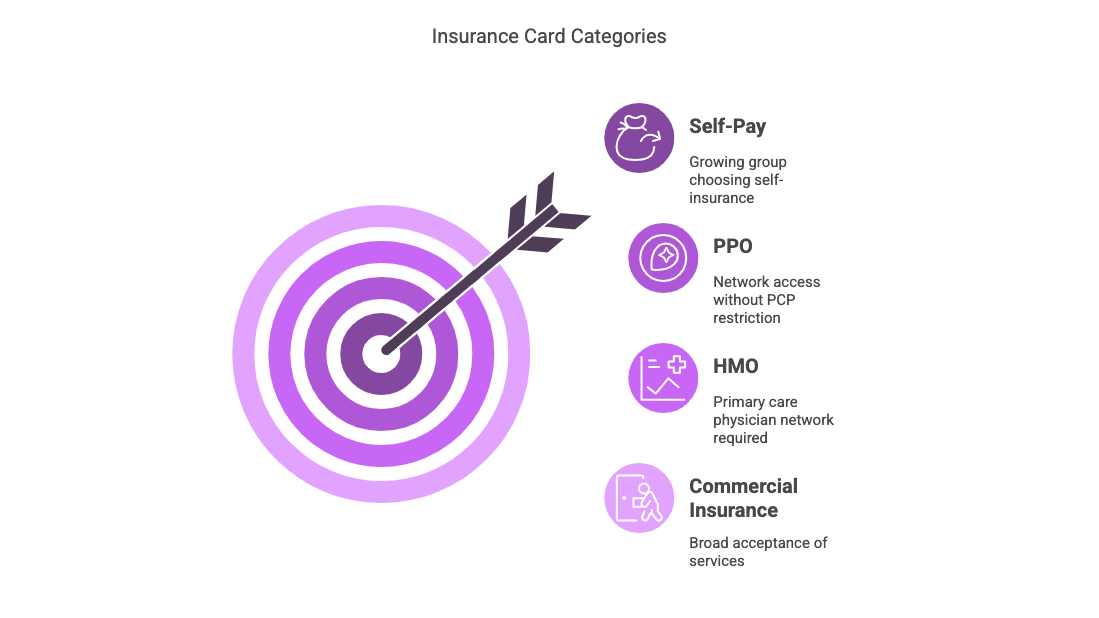

Understanding Insurance Categories

- Commercial Insurance: Patients can seek services anywhere their card is accepted.

- HMO (Health Maintenance Organization): Patients must use a primary care physician within the contracted network.

- PPO (Preferred Provider Organization): Although there is a network, patients aren’t restricted to a specific PCP.

- Self-Pay: This category is increasing as more individuals choose self-insurance. Our practice aims to cater to this growing group, which can feel underserved by traditional insurance models.

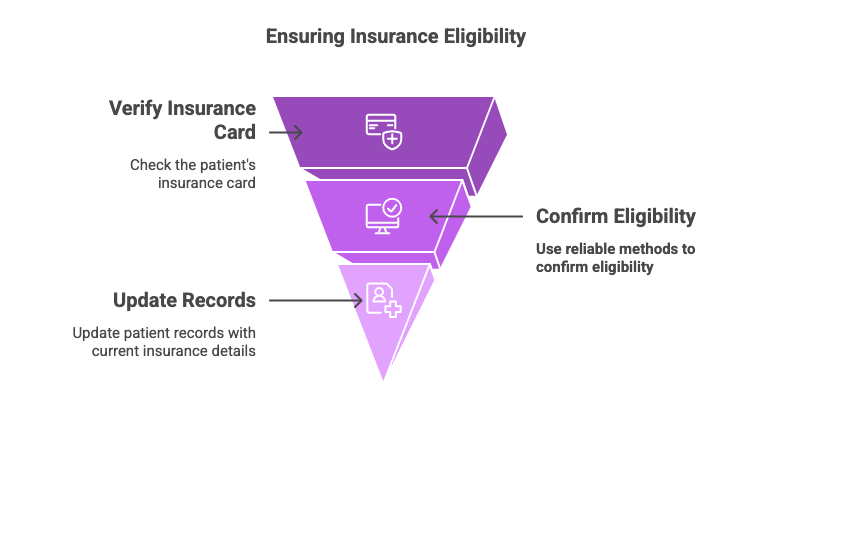

Having the right insurance and eligibility information is crucial for the success of a medical practice. In today’s dynamic insurance landscape, it’s essential not to take anything for granted. Patients often switch insurances frequently, sometimes on a monthly basis. Thus, every interaction between a patient and the front office should include a thorough check of the patient’s current insurance status. It’s vital to confirm details from the patient’s insurance card or through another reliable method to ensure eligibility accuracy.

When examining an insurance card, it typically falls into one of three categories, with a rising fourth:To support self-pay patients, our practice offers in-office visits at a flat rate of $75 and virtual visits for $59.

-

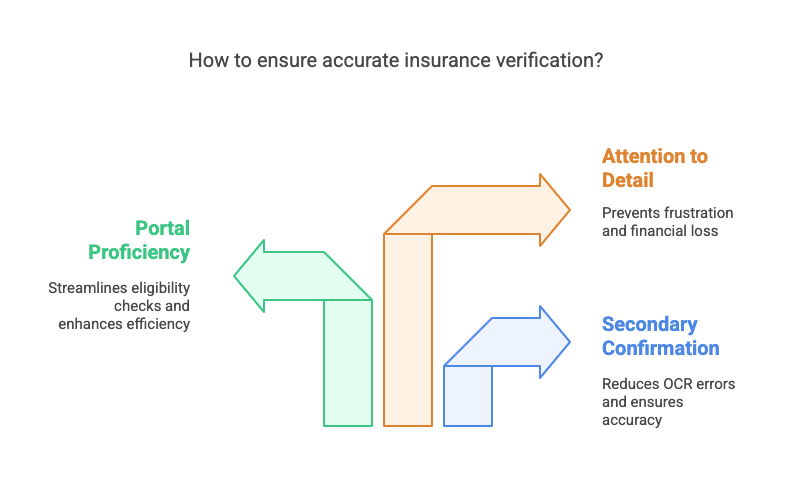

Ensuring Accurate Eligibility Checks

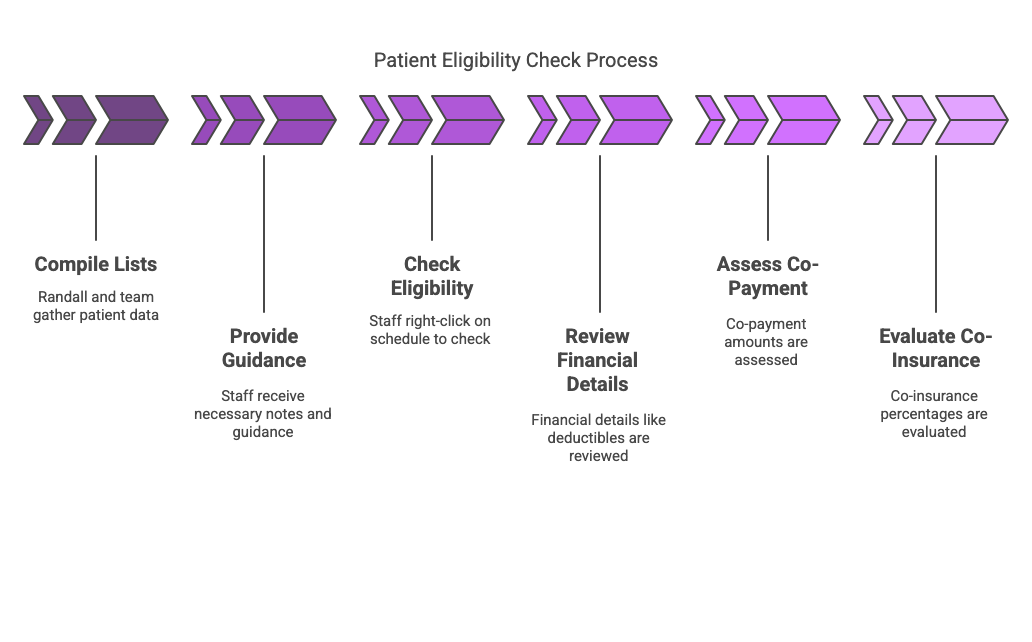

- Deductibles: This is the out-of-pocket amount a patient must cover before their insurance contributes. Typically, deductibles start at $400-$500.

- Co-Payment: Patients pay a fixed amount each time they receive a service.

- Co-Insurance: Beyond a deductible and co-payment, some plans require patients to cover a percentage of expenses. For example, one might have a 20% co-insurance in addition to their deductible and co-payment responsibilities.

Using Technology Effectively

Monthly, Randall and the billing team compile comprehensive lists to help with eligibility checks. They’re consistently working to give staff all the necessary notes and guidance. A practical step for eligibility confirmation is right-clicking on a patient’s schedule and selecting the check eligibility option. During this process, specific financial details need attention:

While technology simplifies many processes, it’s crucial not to rely on it completely. Optical Character Recognition (OCR) errors can occur when scanning insurance cards. Therefore, confirmation through secondary methods remains important.All staff members should have portal access and be familiar with how to utilize platforms like Availity for eligibility checks. Ensuring that everyone is proficient in these tools will smooth out the process significantly.In conclusion, understanding and verifying insurance details is not just administrative; it’s the linchpin in enhancing patient experience and safeguarding revenue. By paying close attention to these areas, we can avoid common pitfalls that lead to frustration and financial loss.

Frequently Asked Questions

What if the patient’s insurance information is incorrect?

Incorrect insurance information can cause problems in the insurance eligibility verification process. To solve this, check patient data carefully when they first arrive, paying special attention to accurate insurance details. Use good strategies like regular updates, training staff, and strong communication with patients. This will help make the verification process smoother and avoid billing mistakes.