Key Highlights

- Certain Medicare Advantage plans offer a give back benefit, which reduces your monthly premium for Medicare Part B.

- This premium reduction is applied directly, either lowering the deduction from your Social Security check or reducing your direct bill.

- Eligibility for these plans depends on your location, as they are not available in all ZIP codes.

- The amount of the give back benefit varies by plan, from a few dollars to the full Part B premium.

- When choosing a plan, consider all features, not just the premium reduction.

- You can enroll in these Advantage plans during specific times, like the annual open enrollment period.

Introduction

Are you looking for ways to increase your monthly Social Security income? You might be surprised to learn that your Medicare plan could be the key. Some specific Medicare Advantage plans offer a “give back” benefit that directly reduces your Medicare Part B premium. This means more of your Social Security money stays in your pocket each month. This guide will walk you through how these plans work, who qualifies, and how you can find one to maximize your benefits.

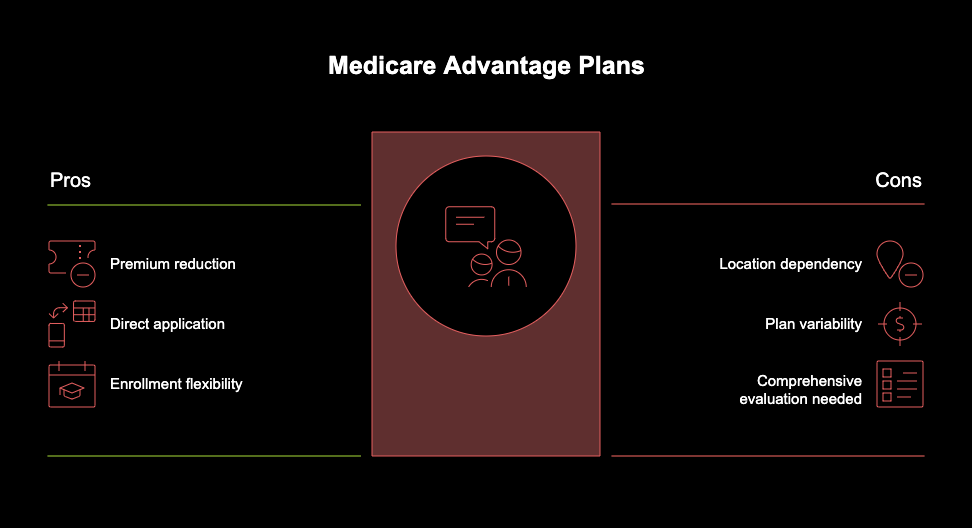

What Are Medicare Give Back Plans?

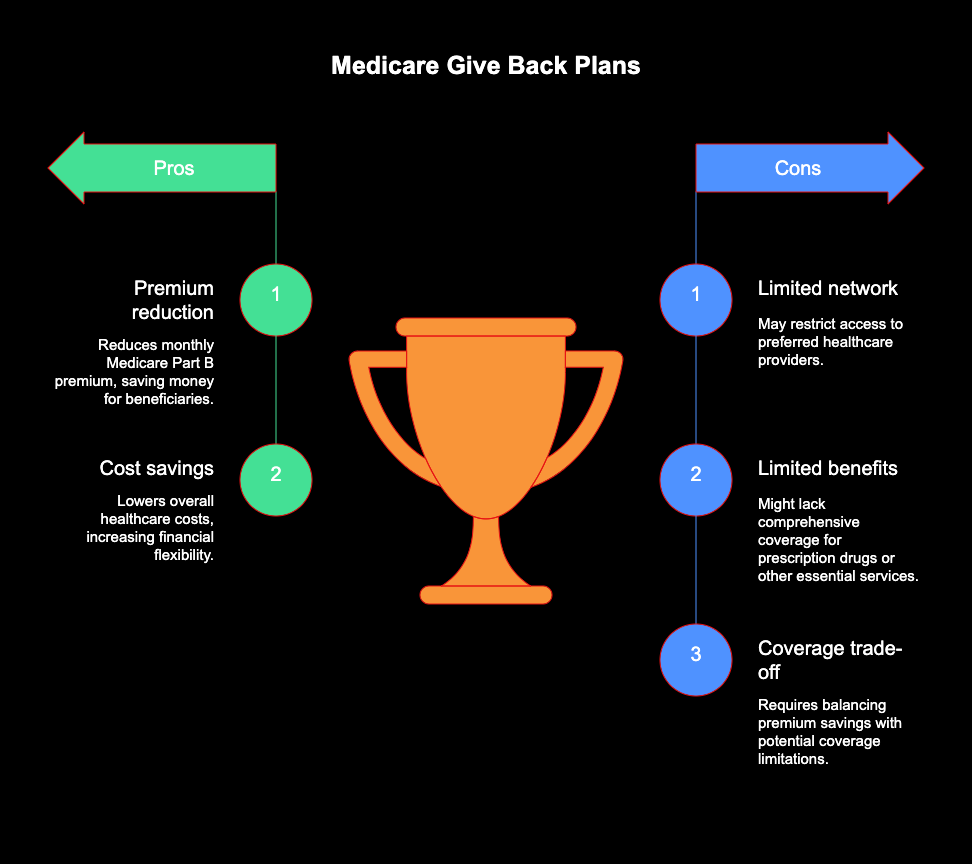

Medicare Give Back plans are a specific type of Medicare Advantage plan offered by a private insurance company. The main benefit is that they help cover a portion, or even all, of your monthly Medicare Part B premium. This feature is often called a Part B premium reduction.

However, a potential drawback is that a plan offering a giveback benefit might have a more limited provider network or may not include other benefits you need, such as robust prescription drug coverage. It’s crucial to weigh the premium savings against the overall coverage the plan provides. Now, let’s explore what these plans are in more detail.

Definition and Purpose of Give Back Plans

Giveback plans are a feature of some Medicare Advantage (Part C) plans that are sold by private insurance companies. Their primary purpose is to help Medicare beneficiaries reduce their monthly expenses by refunding a portion of their Medicare Part B premium. This has been an available option since 2003 but has gained popularity in recent years.

Essentially, the federal government provides funding to insurance companies to offer Medicare Advantage plans. If a company can provide services for less than the government’s payment, it can pass some of those savings back to you in the form of a Part B premium reduction. This makes the plan more attractive and helps you manage your budget.

This giveback benefit is not a separate check you receive. Instead, the insurance company pays part of your premium directly, which lowers the amount you owe each month. To qualify, you must be enrolled in Medicare Part A and Part B and choose an Advantage plan in your area that offers this specific benefit.

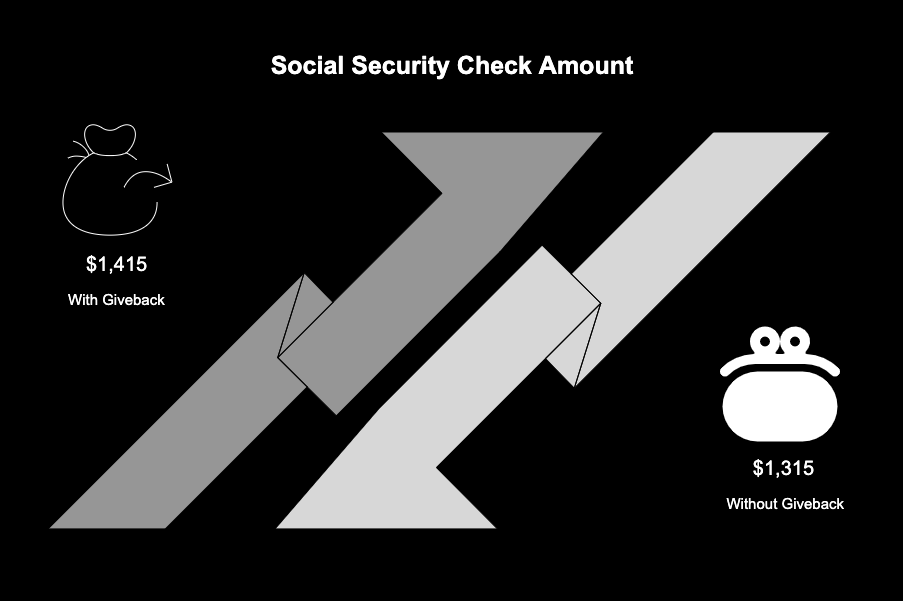

How the Give Back Benefit Works with Social Security Payments

Yes, enrolling in a plan with a Part B giveback can effectively increase the amount of your monthly Social Security check. Most Medicare beneficiaries have their Part B monthly premium automatically deducted from their Social Security benefits. When you enroll in a plan with a premium reduction, that deduction is lowered.

For example, if your Social Security benefit is $1,500 and your Part B premium is $185, you would typically receive a check for $1,315. If you join a Medicare Advantage plan with a $100 Part B giveback, the deduction from your Social Security check would only be $85, increasing your payment to $1,415.

If you don’t receive Social Security and pay your Part B premiums directly to Medicare, the process is even simpler. Your monthly bill from Medicare will be reduced by the giveback amount, so you just pay less out of pocket.

Eligibility Criteria for Medicare Give Back Plans

Qualifying for a Medicare Part B giveback isn’t based on your income. The primary requirements are that you must be enrolled in both Medicare Part A and Part B. After that, the main factor is your location.

You must live within the service area of a Medicare Advantage plan that offers the giveback feature. Since not all plans in every area offer this benefit, your eligibility is directly tied to plan availability in your specific ZIP code. Let’s look closer at who qualifies and other factors that can influence your eligibility.

Who Qualifies for the Part B Give Back Benefit?

To qualify for the Part B giveback program, your eligibility is straightforward and has nothing to do with your income. First and foremost, you must be enrolled in Original Medicare, which includes both Medicare Part A and Medicare Part B. You must also continue to pay your Part B premium.

The next critical step is to find and enroll in a Medicare Advantage plan that includes the giveback benefit. Eligibility is tied to the specific plan you choose, not a general government program. You have to actively select a plan that offers this feature.

Finally, you must live in the plan’s service area. These plans are hyper-local, so a plan offering a giveback might be available in your county but not the next one over. Even if a plan offers a benefit up to the full Part B premium, such plans are rare and geographically limited.

Finding Give Back Plans Available in Your Area

Finding Medicare Advantage plans with a give back benefit requires a bit of local research. Because these plans are specific to a service area, the options available to you depend entirely on your ZIP code. What your friend or relative has in another state might not be an option for you.

You can’t just sign up for a give back benefit; you must enroll in a new plan from an insurance company that offers it. Below, we’ll discuss how to navigate regional differences and the steps you can take to locate these plans.

Steps to Locate and Compare Local Medicare Give Back Plans

To find and compare giveback plans, you need to look beyond the advertisements and check what’s actually available to you. Start by confirming that a plan offers the benefit, but don’t stop there. Comparing the full scope of each plan is critical to making the right choice.

When you’re ready to search, you have a few reliable options. Each allows you to see plans specific to your ZIP code and review their benefits in detail. Carefully read the plan’s summary of benefits or evidence of coverage document to understand all costs and coverages.

Here are a few steps you can take:

- Use the Medicare Plan Finder: Go to Medicare.gov and enter your ZIP code. You can see all available plans and click “plan details” to check if there is a “Part B premium reduction.”

- Contact Insurance Carriers: You can call insurance companies directly, but they will only tell you about their own plans.

- Work with a Licensed Insurance Agent: An independent agent can compare plans from multiple carriers in your area, giving you a more comprehensive view of your options.

Tips for Increasing Your Monthly Income Through Give Back Plans

Finding a giveback plan is an excellent way to put extra money back into your monthly budget. For many Medicare beneficiaries, reducing the monthly Part B premium provides a noticeable boost to their income. The key is to be strategic in your choice.

The giveback amount itself is important, but it’s only one piece of the puzzle. A plan with a high giveback might have higher copays or a restrictive network, which could cost you more in the long run. Focus on the total value of the plan, not just the Part B premium reduction.

To make the most of this benefit, consider these tips:

- Compare the giveback amount against the plan’s other costs, like deductibles and copays.

- Ensure your doctors and preferred hospitals are in the plan’s network.

- Check if your prescription drugs are covered at an affordable cost.

- Evaluate the plan’s star rating for quality and member satisfaction.

Conclusion

In summary, understanding and leveraging Medicare Give Back Plans can significantly enhance your financial well-being. These plans not only provide a way to reduce out-of-pocket costs but also allow you to make the most of your Social Security benefits. By knowing the eligibility criteria, actively searching for available plans in your area, and coordinating your approach, you can optimize your monthly income while avoiding common pitfalls during enrollment. Remember, navigating the options may seem daunting, but you’re not alone in this journey. If you have questions or need personalized guidance, feel free to reach out for a free consultation. Your financial future is important—take the steps today to secure it!

Frequently Asked Questions

Do Medicare Give Back Plans Affect Eligibility for Other Government Benefits?

No, enrolling in a plan with a giveback benefit does not typically affect your eligibility for other government benefits like Social Security or Medicaid services. The Medicare Part B giveback is a feature of a private health plan, not a form of government income assistance, so it doesn’t impact your qualification for other programs.

Are There Any Changes to Medicare Give Back Programs for 2024?

Yes, the availability of plans with a Part B giveback benefit has been expanding. While 19% of Medicare Advantage plans offered this feature in 2024, that number is projected to grow. This means more beneficiaries may have access to a new plan with a Medicare giveback benefit in their area.

Is a Medicare Give Back Plan Worth It Compared to Traditional Medicare Options?

It can be, but it depends on your needs. If you find one of these Advantage plans that reduces your Part B premium, includes your doctors, and covers your prescription drugs affordably, it could be more valuable than Original Medicare. You must compare the total costs and benefits.