Key Highlights

- A Medicare Advantage plan includes a Maximum Out-of-Pocket (MOOP) limit, which is the most you’ll pay for covered medical services in a year.

- This MOOP limit acts as a critical safety net, protecting you from unlimited medical expenses.

- Once you reach your plan’s MOOP limit, your health insurance covers 100% of your approved Part A and Part B costs for the rest of the year.

- Unlike the Medicare Advantage program, Original Medicare does not have a MOOP.

- MOOP amounts can vary significantly from one Medicare Advantage plan to another.

Introduction

Navigating your health insurance options can feel overwhelming, but understanding key features can make it much simpler. If you’re considering a Medicare Advantage plan, one of the most important elements to know about is the Maximum Out-of-Pocket, or MOOP, limit. This feature is a powerful financial safeguard built into your Medicare coverage. It provides a cap on your annual healthcare spending, offering predictability and peace of mind when it comes to managing your medical costs.

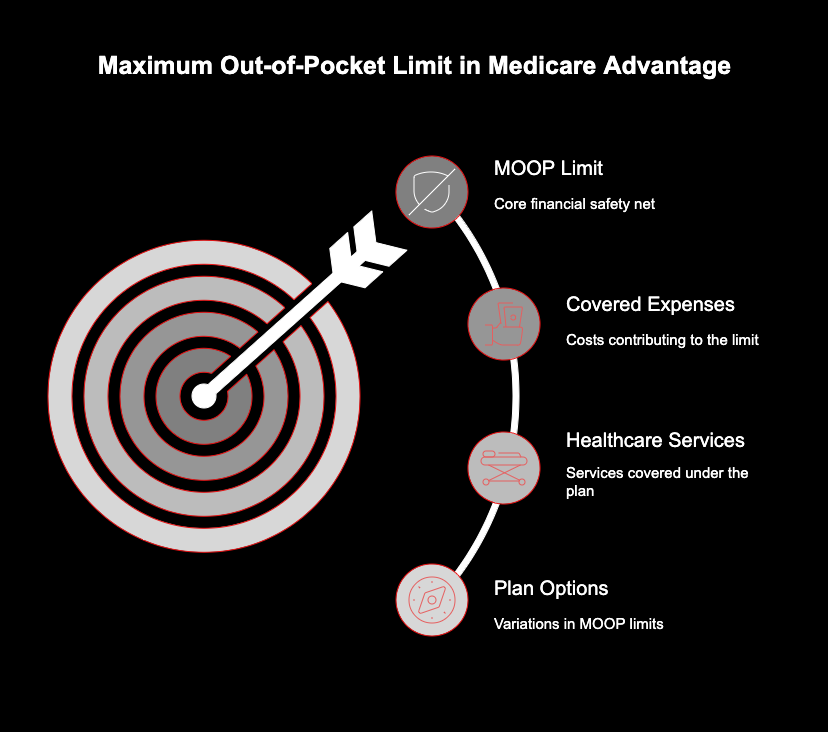

Understanding MOOP in Medicare Advantage Plans

The maximum out-of-pocket (MOOP) limit is a crucial component of Medicare Advantage plans. It serves as a financial safety net, ensuring that once you reach a certain spending threshold for covered medical expenses, you won’t have to pay any more for services such as hospital stays, skilled nursing, or preventive care for the remainder of the calendar year. This limit helps Medicare beneficiaries manage their health care costs, providing peace of mind amidst rising medical expenses. By defining a capped amount for individual plans, MOOP protects enrollees from high outlays in times of unexpected health issues. Understanding this feature is essential for making informed decisions during the Medicare Advantage enrollment period, as it directly impacts how much you’ll pay for your Medicare coverage overall. With MOOP limits varying among plans, knowing your options can lead to better healthcare choices tailored to your health status and financial comfort.

Definition and Purpose of the Maximum Out-of-Pocket Limit

The maximum out-of-pocket (MOOP) limit serves as a crucial financial safety net within Medicare Advantage plans. It represents the highest amount that enrollees must pay for covered health care services within a calendar year. Once this limit is reached, beneficiaries are protected from additional medical expenses, ensuring that they won’t face overwhelming costs, especially during times of serious illness. This feature not only enhances access to needed services but also provides peace of mind, knowing that there is a cap on potential out-of-pocket expenses.

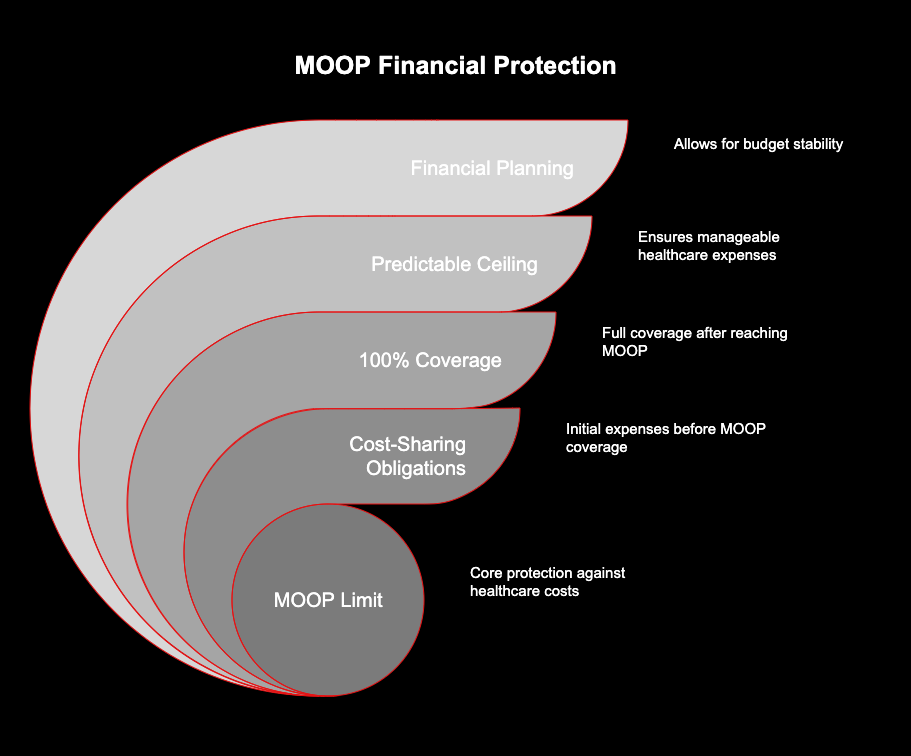

How MOOP Protects Enrollees Financially

The MOOP limit offers crucial financial protection by putting a firm boundary on your annual healthcare expenses. Think of it as your yearly spending cap for medical care. Once you’ve paid up to this amount through your cost-sharing obligations, your health insurance steps in to cover the rest.

Consider this scenario: you’re enrolled in a Medicare Advantage plan with a $6,500 MOOP. After a hospital stay and several follow-up appointments, your out-of-pocket costs for the year hit that $6,500 mark. From that point on, your plan covers 100% of the cost for all eligible Part A and Part B services.

This protection is invaluable because it means:

- Your medical bills have a predictable ceiling.

- You are shielded from unlimited costs in a year with high healthcare needs.

- You can plan your finances without the fear of unforeseen, catastrophic medical bills.

- Your Medicare Advantage plan provides a clear end-point to your spending for the year.

The Importance of MOOP as a Safety Net

During your Medicare Advantage enrollment, understanding the MOOP is essential because it functions as your ultimate financial safety net. Unexpected health issues can arise at any time, leading to a cascade of medical expenses for hospital stays, specialist visits, and treatments. Without a cap, these costs could be financially devastating.

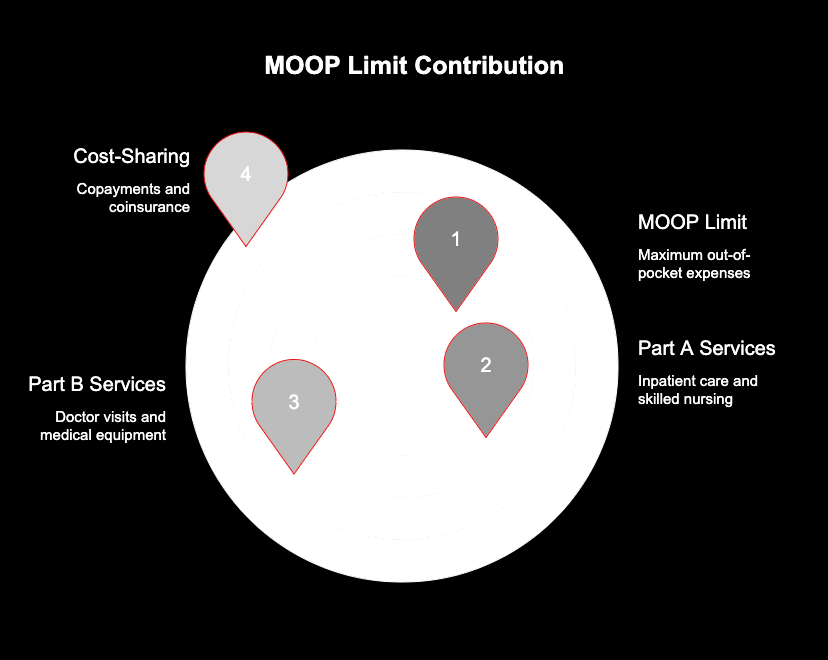

MOOP in Action: How It Works Within Medicare Advantage

The mechanics of the MOOP limit within a Medicare Advantage plan are straightforward. As you pay for covered services throughout the year, each dollar of your cost-sharing—like copayments for a doctor’s visit or coinsurance for skilled nursing care—is tracked against your plan’s MOOP.

Once your total payments reach the MOOP limit, your plan takes over completely for Part A and Part B services. It’s important to know which of your health care costs contribute to this limit and which do not, as not all spending counts.

What Counts Toward the MOOP Limit?

For your spending to count toward the MOOP limit, it must be for services covered under Medicare Parts A and B. Your health plan tracks your cost-sharing payments for these specific services throughout the calendar year.

The most common expenses that accumulate toward your MOOP limit include:

- Deductibles: The amount you pay for covered services before your plan begins to pay. Be sure to check your plan details, as not all plans count the deductible toward the MOOP.

- Coinsurance: Your share of the costs for a covered service, typically calculated as a percentage.

- Copayments: Fixed dollar amounts you pay for specific services, like a doctor’s appointment or a specialist visit.

Covered Services and Expenses Impacting MOOP

The expenses that chip away at your MOOP limit are directly tied to your use of covered services under Medicare Part A and Part B. These are the foundational health care services that cover your hospital and medical needs.

When you receive Part B coverage for services like doctor visits, outpatient hospital care, lab work, or durable medical equipment, your copayments and coinsurance for these services count. Similarly, cost-sharing for Part A covered services, such as inpatient hospital stays and skilled nursing facility care, also contributes to your MOOP.

What Happens After Reaching the MOOP Limit?

Reaching your MOOP limit is a significant milestone in your health coverage for the year. The moment your eligible cost-sharing payments hit this threshold, your financial responsibility for covered services changes dramatically for the remainder of the year.

For the rest of the year, your Medicare Advantage plan will pay 100% of the costs for all Medicare-approved Part A and Part B services. This means you will have no more copayments, coinsurance, or deductibles for covered hospital and medical care.

However, you are still responsible for some costs. After hitting the MOOP limit, you must continue to pay:

- Your monthly Medicare Part B premium.

- Your monthly Medicare Advantage plan premium (if you have one).

- Costs for prescription drugs.

- Payments for any services that are not covered by your plan.

Key Differences: MOOP in Medicare Advantage vs. Original Medicare

One of the most significant distinctions between Original Medicare and Medicare Advantage is the presence of a MOOP limit. This feature fundamentally changes the nature of your financial risk and is a critical factor to consider when choosing your health insurance.

Is There a MOOP in Original Medicare?

The short and simple answer is no. Original Medicare, which includes Part A (Hospital Insurance) and Part B (Medical Insurance), does not have a MOOP limit. This is a defining difference from a Medicare Advantage health plan.

MOOP Amounts and Plan Variations

Not all MOOP limits are created equal. While every Medicare Advantage plan must have one, the actual amount can vary widely. Private insurers that offer these individual plans have the flexibility to set their own MOOP limits, as long as they stay within the maximums established by federal guidelines.

This variation means that you will see different MOOP limits when comparing plans. Some may offer a lower MOOP in exchange for a higher monthly premium, while others might do the opposite. Understanding what influences these amounts can help you choose the right plan.

Typical MOOP Limits for Medicare Advantage Plans

Most Medicare Advantage plans feature a maximum out-of-pocket limit (MOOP) that helps beneficiaries manage their medical expenses. Limits can vary widely, typically ranging from $3,000 to $8,000 for in-network services. Those enrolled in plans with lower MOOP limits often have enhanced cost-sharing arrangements, making healthcare more affordable. Additionally, certain plans cater to specific needs, such as offering lower limits for enrollees who require more extensive healthcare services or medication coverage, providing a safety net that complements overall health coverage.

How and Why MOOP Limits Change Each Year

Your plan’s MOOP limit is not permanent; it can change from one calendar year to the next. The primary driver of this change is CMS, which reassesses and sets the maximum allowable MOOP limit annually. This adjustment is often based on trends in national health care costs.

When overall medical spending rises, the government may raise the maximum allowable MOOP to reflect these higher costs. Private insurance companies then review their plan offerings for the upcoming year and decide on their new MOOPs, which will be at or below the new federal maximum.

Legislation can also play a role. For example, the Inflation Reduction Act introduced a cap on out-of-pocket spending for Part D prescription drugs, a separate but related concept. Factors like the end of a public health emergency or new regulations can also influence how insurers structure their costs and benefits, including the MOOP limit.

Conclusion

In summary, understanding the Maximum Out-of-Pocket Limit (MOOP) in Medicare Advantage plans is essential for safeguarding your financial health. MOOP acts as a crucial safety net, ensuring that enrollees are protected from excessive healthcare costs. By grasping how MOOP functions, what expenses contribute to it, and comparing it with Original Medicare, you can make more informed decisions about your coverage options. As MOOP amounts can vary annually and between different plans, staying updated on these changes will empower you to choose the plan that best meets your needs. If you have more questions or need assistance in navigating your Medicare options, don’t hesitate to reach out for a free consultation!

Questions About MOOP: Frequently Asked Questions

Navigating the intricacies of Medicare Advantage can be daunting, especially when it comes to the Maximum Out-of-Pocket (MOOP) limit. Common questions often arise about how this limit protects Medicare beneficiaries from unexpected medical expenses. Another frequent inquiry pertains to the differences between the MOOP in Medicare Advantage plans and the cost-sharing models in Original Medicare. Many individuals wonder about the typical MOOP limits and how these caps can vary across different health plans, emphasizing the importance of reviewing plan details during Medicare Advantage enrollment.

Are Prescription Drug Costs Included in the MOOP Limit?

No, they are not. The MOOP limit for a Medicare Advantage plan applies only to your cost-sharing for Part A and Part B services. Your Part D prescription drug coverage has its own separate out-of-pocket system. As of 2025, Part D plans have a $2,000 cap on out-of-pocket drug costs.

Can MOOP Vary Between Different Medicare Advantage Plans?

Yes, absolutely. The MOOP limit is one of the biggest variables among individual plans. An HMO in your area might have a different MOOP than a PPO. Even two similar plans from different insurers can have different limits. Special Needs Plans (SNPs) may also have unique MOOP structures based on the populations they serve.

How to Compare MOOP Limits Across Plan Options?

The best time to compare the MOOP limit of any Medicare plan is during the annual Open Enrollment Period. You can use the official Medicare Plan Finder tool at Medicare.gov, contact your State Health Insurance Assistance Program (SHIP) for free, unbiased help, or call 1-800-MEDICARE to get information on different plans.