Key Highlights

Here is a quick guide on what you need to know about the Medicare Annual Enrollment Period (AEP).

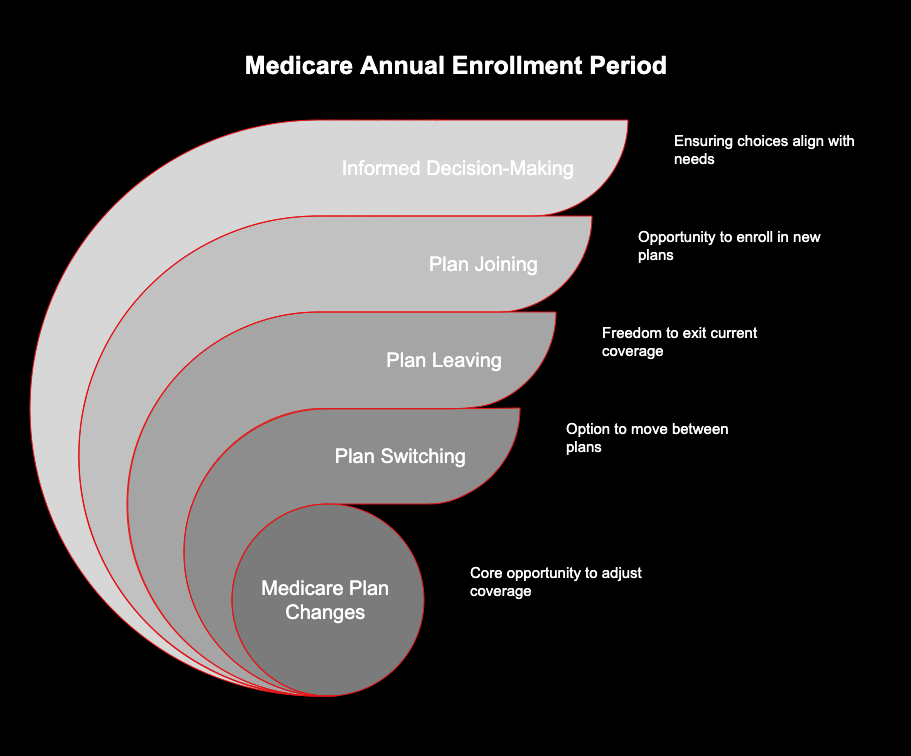

The Medicare Annual Enrollment Period happens once every year. During this enrollment period, you get to change your Medicare plan. AEP is very important for anyone who have Medicare. You can switch, leave, or join a new plan at this time. This is a good chance for you to look at your options to make sure your plan is right for you. Make sure you pay attention, because what you pick during AEP will last until the next annual enrollment period. You can read more about AEP and how the enrollment period works so you make the best choice for your health care.

- The annual enrollment period goes from October 15 to December 7 each year.

- During AEP, you can switch from Original Medicare to a Medicare Advantage plan, or go back to Original Medicare.

- This is when you can change your Medicare Advantage plan or update your Part D prescription drug coverage.

- Any changes you make in AEP will start on January 1 next year.

- If you do not make changes during AEP, you might still have a chance to switch your Medicare or your prescription drug coverage at other times, like during a Special Enrollment Period.

Introduction

The calendar shows that the Medicare Annual Enrollment Period has started. This is an important time to look at your healthcare coverage. In this enrollment period, you get to see your health plan and decide if it still works for you. Now, you can check out different Medicare Advantage choices. This is the best way to make sure your coverage is right for the next year. Are you ready to get the most out of this enrollment period? Let’s get started.

Understanding the Medicare Annual Enrollment Period (AEP)

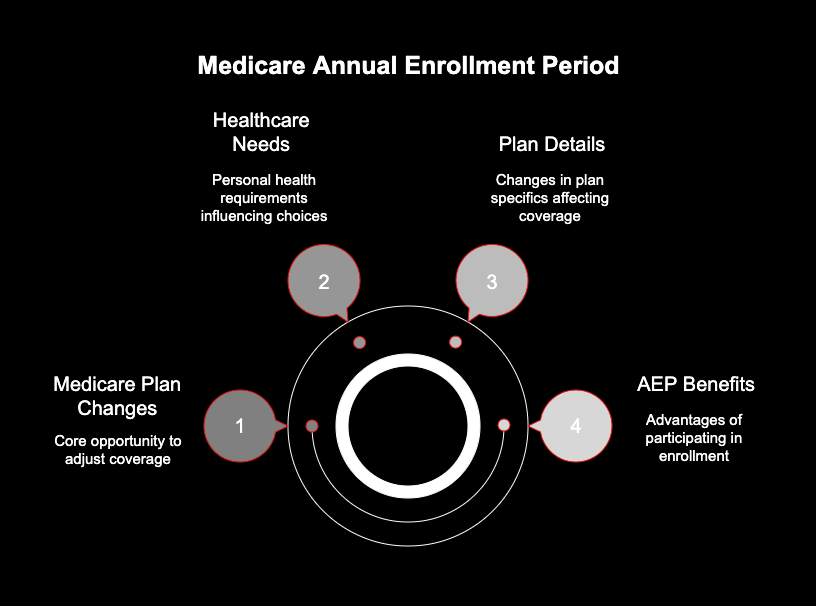

The Medicare Annual Enrollment Period, or AEP, is a special time each year when people who have Medicare can review their healthcare and prescription drug plans. During the enrollment period, you can change your Medicare plan. The annual enrollment period matters because your healthcare needs can go up or down each year. Also, the year can bring changes to the details of your Medicare plan. So, it is good for Medicare beneficiaries to look at their options during AEP and make changes if they need to.

Think of AEP like a yearly check-up for your healthcare and insurance. You get to look at your coverage and see if it is the right fit for you. AEP helps you keep your insurance good and makes it easy to pay for. If you use this enrollment period, you can make your healthcare better for next year.

Timeline for AEP: Key Dates You Need to Know

Mark your calendar. The annual election period happens the same time every year. This is the open enrollment period. You get a set window to make changes to your health coverage. So, this is the time to look at your options and make changes if you need to. Open enrollment comes fast. Be ready for the annual election period.

The AEP begins on October 15 and ends on December 7. If you choose a new plan during this time, it will start on January 1 of the next year. For example, if you pick a new plan on November 20, you get coverage starting on New Year’s Day.

Here is a simple breakdown of the timeline:

|

Date |

Action |

|---|---|

|

October 15 |

The Annual Enrollment Period begins. You can start making changes. |

|

December 7 |

The Annual Enrollment Period ends. This is the last day for changes. |

|

January 1 |

Your new plan coverage, if you made a change, takes effect. |

Why the AEP Matters for Your Medicare Choices

You may wonder why the enrollment period is so important. The reason is that your medical needs can change every year. Also, details of your Medicare Advantage plan may be different with each new year. It is very important to keep up with these changes. AEP is a time when you can look at your Medicare coverage and make sure it fits your needs now and for the future. Use this enrollment time to pick the benefits that work best for you and your healthcare.

The Medicare Advantage Window: Opening, Closing, and What It Means

The Medicare Advantage window is known as the annual enrollment period. It is held each year from October 15 to December 7. This is the main time to sign up for a Medicare Advantage plan. In this enrollment period, you can join a Medicare Advantage plan for the first time. You can switch from one Medicare Advantage plan to another. If you want, you can leave your Medicare Advantage plan and go back to original Medicare during this time.

Changing Coverage During AEP: Options and Strategies

The annual enrollment period gives you a chance to look at your Medicare coverage. You can make changes to your plan if you need to for next year. You get several options, so your Medicare plan can fit what you want.

In this enrollment period, you can look at what you have now and see if you need to make any necessary changes to your Medicare plan for next year. This helps you keep your coverage in line with your needs.

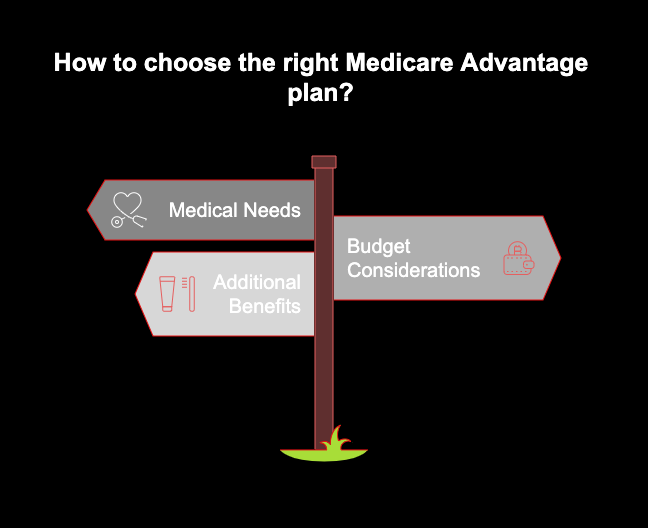

How to Compare Medicare Advantage Plans Effectively

When you look at medicare advantage plans, you have to check all that comes with it. Do not pick a plan just by seeing one thing. A plan should fit your medical needs and it should also be good for your budget. Do not start by only seeing the monthly cost. Instead, see how the plan covers what you need for medicare and what you get when you use it.

You need to think about all the costs you will get with your plan. This means you need to look at deductibles, copayments, and the most you will have to pay from your own pocket. You should also look at additional benefits that are in the plan. These may be things like dental, vision, or hearing coverage. Some companies may not have as many extra services now. So, make sure you see what the plan really gives.

To make an effective comparison, be sure to:

- Make sure your doctor is in the plan’s network. The hospital you like should be in it too.

- Check to see that all your prescription drugs are on the plan’s list.

- Compare all the costs you pay. Do not look at only the amount you pay each month.

- Look at extra features. This can be things like dental, vision, wellness programs and other additional benefits.

Prescription Drug Coverage: What Can You Change During AEP

Your prescription drug coverage is very important in the way you take care of your health. AEP is the best time to see if your coverage is right for you. During AEP, you have the chance to pick new options or make changes to your Medicare Part D plan. This is when you should check your prescription drug coverage and see if it meets your needs now. Use AEP to look at your Part D choices and make sure your Medicare Part D coverage will work for you. This way, you can feel good about your healthcare plan for the year.

You can join a Medicare prescription drug plan (Part D) if you do not have one now. If you already have a plan, you can change to a new prescription drug plan. You can also stop your drug coverage.

What If You Miss Your Medicare Advantage Window?

Sometimes life gets busy. You might miss the December 7 deadline for the Annual Enrollment Period. If you do not sign up then, do not feel bad right away. It is good to know what comes after this. If you do not join during AEP, most people will stay in the same healthcare plan for the next year. This works fine if you like the plan you have. But problems can show up if the plan now costs more or has fewer good benefits.

Special Enrollment Periods and Possible Exceptions

If you did not join a plan during AEP, you may still have a chance to change your plan. There are a few exceptions to think about. One of the main exceptions is the Medicare Advantage Open Enrollment Period. This open enrollment period is from January 1 to March 31. If you are in a Medicare Advantage plan right now, you can use this time to switch to another Medicare Advantage plan. You also have the option to go back to Original Medicare during this enrollment period.

You might get a special enrollment period if you go through certain life events. The special enrollment period lets you change your coverage when it is not time for the usual enrollment period. Not everyone can use the special enrollment period. But, it is very important to have it if things in your life affect your coverage. The enrollment period gives you a good chance to update your plan when you need to.

Common life events that may trigger a SEP include:

- If you go to a new home that is not in the area your current plan covers, you can change your plan.

- If you lose other health coverage you have, like coverage from your job, you may be able to switch your plan too.

- If you get Medicaid or other help programs, you can start a new health plan.

- If your current plan changes a lot about who is in its network, you might have some time to pick another plan.

Potential Consequences of Missing AEP

If you miss your enrollment during AEP, it can change your Medicare coverage. This can make the way you get healthcare and deal with money different for the year. The main thing is you have to stay with your current medicare plan. You have to keep it even if you feel it does not fit you anymore or now costs more.

This can make you pay more for things like premiums, deductibles, and copayments. You may feel you give too much for these when it is not needed. You might find a medicine you use is not in your plan’s list. A new doctor you want could be outside your plan’s network. So, you will pay more from your own pocket.

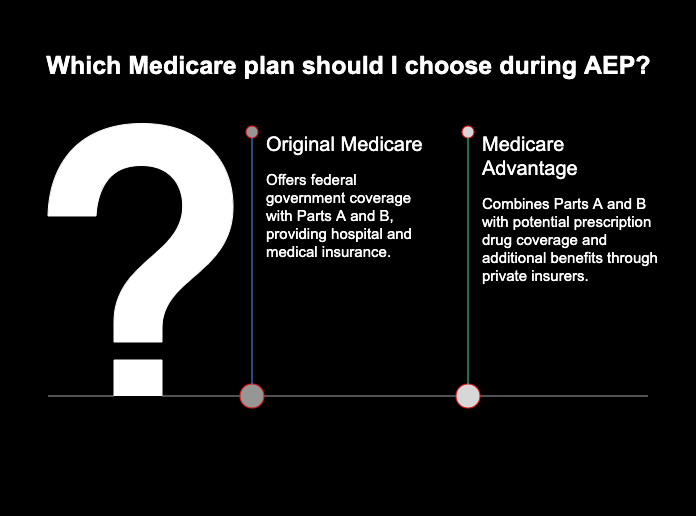

Differences Between Medicare Advantage and Original Medicare During AEP

The annual enrollment period is the key time to look at your medicare coverage and pick what works best for you. You can choose between two main options: original medicare or medicare advantage. Original medicare is the plan from the federal government. It gives you hospital insurance, called Part A, and medical insurance, called Part B. During this enrollment period, you can change your current plan or sign up for new medicare coverage. This is the best time to make sure your medicare fits your needs for the year.

Medicare Advantage, which people call Part C, be a type of plan from private insurance companies. With this plan, you get both Part A and Part B together. It can also help with prescription drug coverage. Some benefits in Medicare Advantage are not in original Medicare. AEP be the time when you look at your options and compare Medicare Advantage with original Medicare. You can switch plans during AEP.

Advantages of Medicare Advantage Compared to Original Medicare

Many people pick Medicare Advantage because it can make life easier and adds some extra perks. You get all your medical needs in one plan, not several like original medicare. There will be hospital care, doctor visits, and prescription drug coverage, all put together in high-readability way in one plan.

Many people like these medicare plans because they come with extra benefits that you do not get from original medicare. This means you may save some money and get care that covers more things. Also, these medicare plans put a yearly cap on what you pay out of your own pocket. So, you get some help with your money, which is something original medicare does not do, unless you have another plan to help with costs.

Key benefits of medicare advantage plans often be:

- You get coverage for things medicare may not include, such as dental and vision care.

- There can be lower out-of-pocket costs to pay.

- Many plans come with extra services and wellness programs.

- A medicare advantage plan often lets you have one easy-to-use card for all benefits.

- A provider network may help you find good doctors and hospitals in your area.

- The plan helps you with dental, vision, and hearing care.

- It includes prescription drug coverage with part d.

- The plan has a yearly cap on what you spend. This means you and others do not pay too much in one year.

- You can join wellness programs and get gym memberships.

Limitations to Be Aware of When Deciding Between Plans

Medicare Advantage plans offer you good perks. However, it is important to know the limits. The biggest limit is that you have to stay in their network. With most medicare advantage plans, you need to see the doctors, specialists, and hospitals in the plan’s network to be covered. If you visit someone outside their network, you might pay much more. Sometimes things outside the network are not covered at all. So, before you pick a medicare advantage plan, make sure you understand this.

Finding Reliable Help: Where to Get Enrollment Assistance

Getting started with Medicare may feel hard, but you are not alone. There are many trusted sources out there to help guide you with enrollment. These sources can share advice that fits your needs. You can get help from licensed experts and groups in your area. They are here to help you learn about your choices for Medicare enrollment.

Consulting Licensed Agents and Medicare Advisors

One good way for people to get help with medicare is to talk with licensed insurance agents or Medicare advisors. Some agents work with one company. Independent brokers do not work for just one insurer. They can offer you several plans. This helps you look at, compare, and pick the one that will be best for you.

A good advisor helps you know what you need. The advisor will guide you through the plans. He or she can also help with enrollment. It is important to have someone honest working with you. A good professional puts your needs first.

To find a trustworthy agent or advisor, you can:

- Ask friends, family, or your doctor to give you the name of a good broker.

- Check what the broker can do on your state’s Department of Insurance website.

- Find some trusted brokers on lists you will see from the National Council on Aging.

Conclusion

As we get to the end of the Medicare Annual Enrollment Period (AEP), it’s easy to see this is an important time for many of us to make smart decisions about our healthcare. The annual enrollment period tells you when you can sign up. You need to know if you can enroll and what choices you have for your current plan. What you do now during AEP affects the healthcare and benefits you get.

Get your paperwork set. Think about your health. Look closely at your current plan before you make any changes. If you miss the enrollment period, it may be hard or not possible to change your plan for a year. This could bring problems later.

If you feel lost or have questions, don’t worry. Reach out for help. We are here for you with AEP and we will help you make good choices for your health. Start now and make sure you take care of your enrollment.

Frequently Asked Questions

Can I change my Medicare prescription drug coverage during the Annual Enrollment Period?

Yes, you can do that. The Annual Enrollment Period is the time for people to look at and change their prescription drug coverage. AEP lets you join, leave, or switch your Medicare Part D prescription drug plan. You can pick a plan that is good for your needs in the coming year. The part d enrollment period is a key time to look at your options for prescription drug coverage in Medicare.

What should I do if I miss my opportunity to enroll or switch plans?

If you miss the AEP, you still have some ways to change your Medicare plan. The Medicare Advantage Open Enrollment Period runs from January 1 to March 31 every year. You can use this enrollment period to review and update your medicare advantage coverage.

If you have a Special Enrollment Period, you can also change your medicare plan. A special enrollment period opens if you have big life events, like moving or if you lose other health coverage. You can make changes when there is an open enrollment period or if these life events happen. It’s good to use your time to look at your enrollment options. This way, you can get the right medicare coverage that fits you and your life.

How do I compare Medicare Advantage options for my healthcare needs?

To compare Medicare Advantage plans, you should look at more than just the monthly cost. Think about the money you need to pay for deductibles and copays as well. You have to see if your main doctors work with the plan. Make sure the prescription drugs you use are in the list covered by the plan. At the end, look at your current plan and see which choice gives you more healthcare benefits.